Estimated taxes 2021

IT-2658-NYS Fill-in 2021 IT-2658-I Instructions Attachment to Form IT-2658 Report of Estimated Personal Income. This saves you from having to submit payments yourself.

How To Calculate Estimated Taxes 1040 Es Explained Calculator Available Youtube

Download 21798 KB.

.png)

. Or d your expected estimated tax liability exceeds your withholding and tax credits by 150 or less. Youll pay 10 on the first 19900 of taxable income and 12. And any additions to.

Payments due April 15 June 15 September 15 2021 and January 18 2022. Income taxes are pay-as-you-go. This includes earnings from self-employment interest dividends rental income alimony etc.

Ad Use Our Free Powerful Software to Estimate Your Taxes. Enter Your Tax Information. Missouri estimated tax - Your Missouri estimated tax is the.

Matching estimated tax payments to. Then income tax equals. Marginal tax rate 22 Effective tax rate 1198 Federal income tax 8387 State taxes Marginal tax rate 633 Effective tax rate 561 New York state tax 3925 Gross income 70000 Total income.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP. Estimated Tax Payment Voucher for Individuals.

If youre a calendar year taxpayer and you file your 2022 Form 1040 by March 1 2023 you dont need to make an estimated tax payment if you pay all the tax you owe at that. WASHINGTON The Internal Revenue Service today reminds those who make estimated tax payments such as self-employed individuals retirees investors businesses corporations and others that the payment for the first quarter of 2022 is due Monday April 18. The Division of Revenue links for online filing options.

The investment income limit for 2021 was raised from 3650 to 10000. Calculate Your Tax Refund For Free And Get Ahead On Filing Your Tax Returns Today. Attachment to Form IT-2658 Report of Estimated Metropolitan Commuter Transportation Mobility Tax MCTMT for New York Nonresident Individual Partners.

Paying estimated taxes requires you to estimate in advance how much you expect to owe the government in taxes for the current tax year. You then send in four quarterly payments that together total that amount. The due dates for quarterly estimated payments fall near the middle of the months of April June September and January.

WHEN TO FILE Make estimated payments online or file Form 760ES Payment Voucher 1 by May 1 2021. Personal Income Tax Forms Current Year 2021-2022 Due in part to the pandemic the Delaware Division of Revenue anticipates delays in processing paper returns for the 2022 filing season. IT-21059 Fill-in IT-21059-I Instructions Underpayment of Estimated Tax By Individuals and Fiduciaries for tax year 2021.

Using the 2021 standard deduction would put your total estimated taxable income at 35250 60350 - 25100 placing you in the 12 tax bracket for your top dollars. Single Individuals Not over 9950. 2021 Personal Income Tax Forms.

The department will be able to process 2021 personal income tax estimated payments made in 2021 if taxpayers complete and mail a PA-40ES I Declaration of Estimated Tax coupon to the department along with their check for the estimated tax amount. Reconciliation of Estimated Tax Account for Individuals. Estimated income tax is the amount of Vermont tax you expect to owe for the year on income that is not subject to withholding.

This results in the same amount of money being set aside without you having to do anything. The 2022 Estimated Tax Worksheet The Instructions for the 2022 Estimated Tax Worksheet The 2022 Tax Rate Schedules and Your 2021 tax return and instructions to use as a guide to figuring your income deductions and credits but be sure to consider the items listed under Whats New earlier. For example if the results from this calculator tell you to pay 1200 quarterly have your employer increase your withholding by 200 on your biweekly payroll.

Estimated Income Tax Worksheet on Page 3 is less than 11950. Form is used by individual taxpayers mailing a voluntary or mandatory estimated payment. As a result please consider filing your return electronically instead of submitting a paper return.

Estimated tax is the method used to pay tax on income that isnt subject to withholding. IT-21051 Fill-in Instructions on form. 100 of the tax shown on your 2021 return.

Ad Try Our Free And Simple Tax Refund Calculator. Payments due April 18 June 15 September 15 2022 and January 17 2023. 425 57 votes The deadline for making a payment for the fourth quarter of 2021 is Tuesday January 18 2022.

You wont owe an estimated tax penalty if the tax shown on your 2022 return minus your 2022 withholding is less than 1000. Estimated income tax payments must be made in full on or before May 1 2021. 100 Accurate Calculations Guaranteed.

For example in 2022 the. Estimate My 2021 Tax Return Your Account Start a New Account Login to My Account. Filing requirements - You are required to file a declaration of estimated tax if your Missouri estimated tax is expected to be 100 00 or more Section 1435211 RSMo.

IR-2021-125 June 8 2021 WASHINGTON The Internal Revenue Service reminds taxpayers who pay estimated taxes that they have until June 15 to pay their estimated tax payment for the second quarter of tax year 2021 without penalty. This 10000 figure will be pegged to inflation and adjusted accordingly every year going forward. Use this package to figure the estimation of tax in 2021 TY.

2021 Form MO-1040ES Declaration Of Estimated Tax For Individuals - General Instructions 1. Individual Estimated Tax Payment Form. Taxpayers should write 2021 Estimated Tax Payment and the last four digits of the primary.

10 of the taxable income. See What Credits and Deductions Apply to You. This means that taxpayers need to pay most of their tax during the year as income is earned or received.

A partnership or S corporation mailing a voluntary estimated payment on behalf of its nonresident individual partnersshareholders participating in the filing of a composite return.

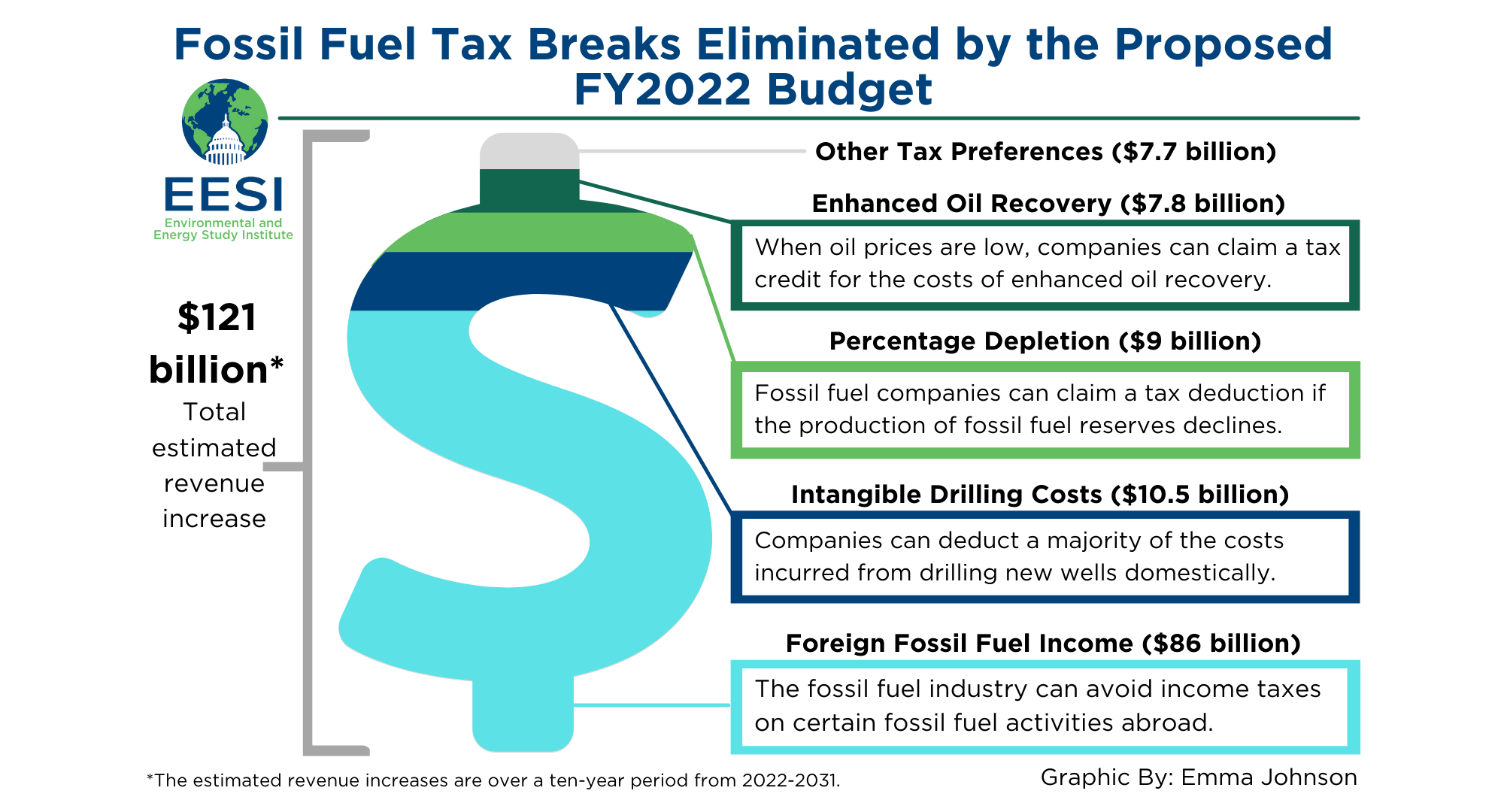

Fact Sheet Proposals To Reduce Fossil Fuel Subsidies 2021 White Papers Eesi

What Happens If You Miss A Quarterly Estimated Tax Payment

How To Calculate Estimated Taxes 1040 Es Explained Calculator Available Youtube

How Much Does A Small Business Pay In Taxes

Tax Schedule

Estimated Tax Payments Youtube

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Tax Center For Phds In Training For 2021 2022 Personal Finance For Phds

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Tax Schedule

When Are Taxes Due In 2022 Forbes Advisor

Tax Evasion Among The Rich More Widespread Than Previously Thought The Washington Post

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Estimated Tax Payments For Independent Contractors A Complete Guide

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download