Mortgage scenario calculator

A mortgage with a 1-yr term paid monthly has 12 payment periods. The payment period is an indicator of the number and order of payments.

Mortgage Calculator With Extra Payments Payment Schedule

Mortgage lending is a major sector.

. Based on our calculator if you apply for a mortgage with your spouse a lender may grant you a mortgage amount between 211600 to 306600. A mortgage with a 2-year term paid semi-monthly has 48 payment periods. A mortgage payment calculator takes into account factors including home price down payment loan term and loan interest rate in order to determine how much youll pay each month in total on your home loan.

Compare the cost of buying and renting in your location with your personalized scenario. Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules. The mortgage crisis has led to a rise in foreclosures leading to the 2010 United States foreclosure crisis Mortgage lenders.

Use Moneys free mortgage calculator to get an estimated monthly mortgage payment based on your loan details. You can choose to apply the extra payment to any of the payment periods for example the 5th 10th or 41st period. In this scenario the maximum amortization period is 25 years.

In essence our Finance Calculator is the foundation for most of our Financial Calculators. This tool is intended for loan officers and lending partners. Keep in mind that this option should be reserved for a worst-case scenario in which your inability to make payments could put you at risk of defaulting on your loan.

If you change your down payment to more than 20 you may not require mortgage default insurance and the maximum amortization period can be 30 years. This tool is for estimation purposes only. Make sure you understand your reference rate margin how your monthly loan payments might change in the worst case scenario before signing an ARM loan contract.

This will save a considerable amount of interest costs. How much can you save. This Mortgage Calculator assumes the following.

The typical scenario is that terms of the loan are beyond the means of the ill-informed and uneducated borrower. If you are a homebuyer please have your loan officer walk through this with you. So if you buy two points at 4000 youll need to write a check for 4000 when.

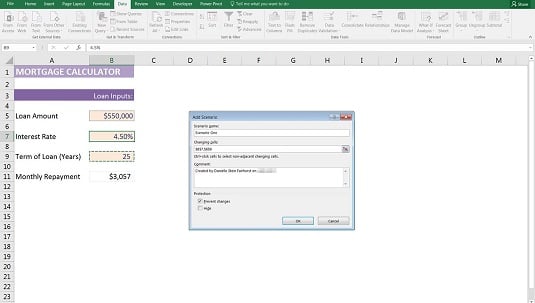

Scenario 1 Scenario 2 Scenario 3. The actual amount will still depend on your affordability. You can even compare scenarios for different down payments amounts amortization periods and variable and fixed mortgage rates.

Constant annual interest rate throughout amortization period. The CFPB published Consumer handbook on adjustable-rate mortgages which offers consumers an introductory guide to ARM loans including a. Our mortgage calculator reveals your monthly mortgage payment showing both principal and interest portions.

7YR Adjustable Rate Mortgage Calculator. For example add a third 30-year fixed-rate. However some lenders have.

However if your mortgage rate is higher than your savings rate which is more likely then it makes better sense to overpay your mortgage. Such a scenario leads to what is commonly called a long initial period and odd. Selected Rate -Average 5-year Fixed Rates 2000 - 2010 389 -Average 5-year Fixed Rates 1990 - 2000.

Amortization Period The period of time it will take to pay off the principal amount of a mortgage. One mortgage point typically costs 1 of your loan total for example 2000 on a 200000 mortgage. Calculatormortgageamortization calculatormortgageamortization 1.

The Ultimate Mortgage Calculator calculates mortgage payment amount term down payment or interest rate creates payment plan with dates points and more. Now you may be wondering How much would I have to pay on my scenario in order to pay down the Reverse Mortgage over time if I were to get one All Reverse Mortgage has developed the first ever. The borrower makes a number of interest and principal payments and.

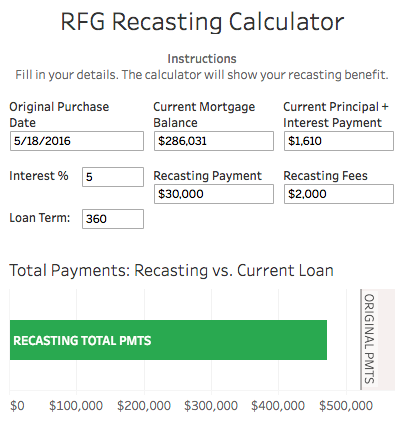

Because interest rates and terms can vary depending on whether the property is an investment property or owner-occupied we have a commercial mortgage calculator for each scenario to give you the most accurate estimates possible. Now add a third scenario to review. See a complete mortgage amortization schedule and calculate savings from prepaying your loan.

A commercial mortgage is a more complex concept. Mortgage default insurance rates CMHC insurance rates 1. Our mortgage payment calculator shows you how much youll need to pay each month.

Use this calculator to compare CalHFA loans. Interest is compounded semi-annually. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more.

Most commercial mortgage amounts range between 150000 and 5000000. Final loan figures may be. A mortgage calculator helps prospective home loan borrowers figure out what their monthly mortgage payment will be.

This is a loan that a business acquires in order to own property in an area zoned as commercial. To determine which mortgage default insurance premium rate you have to pay the first step is to calculate how much your down payment is as a percentage of your homes purchase price. The chart below outlines the premium rates for each down payment scenario.

Download our FREE Reverse Mortgage Amortization Calculator and edit future appreciation rates interest rates and even future withdrawals. Note that this not an official estimate. Whether the business intends to take up residence on the property immediately build on the land or simply hold it for a designated period the banks point of view is still the same.

You might go to the closing on July 15 and the first payment might not be due until September 1. Mortgage Amount The total amount of the mortgage. Our calculator includes amoritization tables bi-weekly savings.

It helps to think of it as an equivalent to the steam engine that was eventually used to power a wide variety of things such as the steamboat railway locomotives factories and road vehicles. Youll have to invest time money and energy in. Most low-down mortgages require a down payment of between 3 - 5 of the property value.

Mortgage programs which require a minimal down payment. Click it to return to the main calculator screen. Based on a 200000 mortgage at a fixed 3 APR you can save over 5000 if you make an overpayment of 50 per month.

Check out the webs best free mortgage calculator to save money on your home loan today. The Importance of the Finance Calculator. If you are a Scotiabank mortgage customer depending on the mortgage solution that you select each year you can increase your scheduled monthly payments by up to 10 15 or 20 of the payment initially set for your term or in some cases your current payment and make a lump sum prepayment of up to 10 15 or 20 of your original principal.

Refinance Calculator Calculate how your new monthly payments will change if you refinance.

Which Mortgage Is Better 15 Vs 30 Year Home Loan Comparison Calculator

Mortgage Payoff Calculator With Extra Principal Payment Free Template

Advanced Loan Calculator

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Extra Payment Mortgage Calculator For Excel

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Mortgage Payoff Calculator With Extra Principal Payment Free Template

Mortgage Amortization With Paydown Savings Calculator Spreadsheetman Spreadsheet Gallery

Loan Repayment Calculator

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel

How To Use Scenario Manager To Model Loan Calculations Dummies

Interest Only Mortgage Calculator Freeandclear

Pay Off Mortgage Vs Invest Calculator

Mortgage Payoff Calculator With Extra Principal Payment Free Template

Reverse Mortgage Calculator How Does It Work And Examples

Mortgage Recast Calculator Figure Out When To Recast Real Finance Guy

Mortgage Payoff Calculator With Line Of Credit